Outstanding Car Finance Check

Lots of people use finance schemes to buy a car. So if you’re interested in a used car there’s a good chance it was bought on credit. Buying a car with outstanding finance means paying for it twice. If not more. To avoid this, check if a car is on finance before you commit. All you need is the vehicle registration number and less than a minute. Just type the reg into the box below.

Read moreWhy do you need an outstanding car finance check?

If you buy a car with an outstanding loan or finance agreement on it, you face a number of challenges as soon as you hand over your money.

You will need to deal with the vehicles finance company that is owed money, the previous owner who sold you the vehicle, and you'll likely need to seek legal advice with Citizens Advice Bureau or a solicitor.

It is a quick and simple process to check a vehicle that you would like to purchase safely and legally with Car Reg Checks. Our reports will accurately return data for any UK registered vehicle containing 35+ different data point checks, which will include any outstanding car finance.

For more information please read our guide on how to avoid buying a car with outstanding finance.

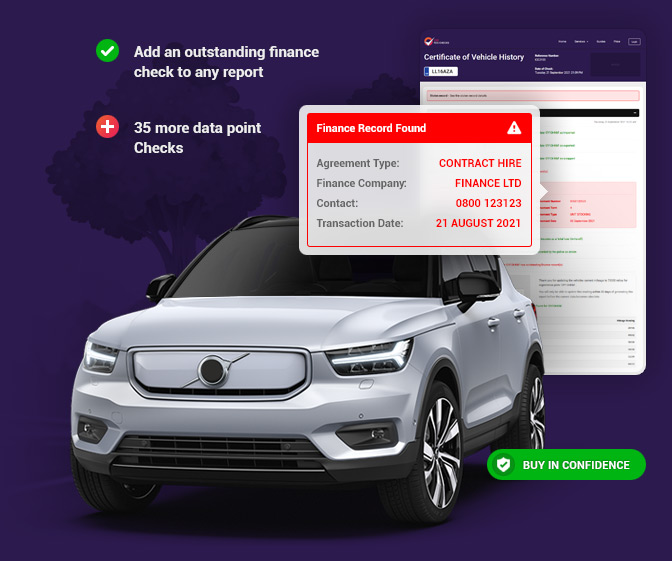

What information does our Car Finance Check Include?

Our outstanding car finance check is an add-on which can be selected when looking up any UK registered VRM (Vehicle Registration Mark). Our car finance record includes the following details:

- Lending company *

- Type of financial agreement

- Agreement number (Reference number)

- Agreement Date

- Finance company contact details *

* If the finance company no longer exists or is trading by a different name this field can initially appear blank. Please contact our support team and we can carry out an investigation to find these details for you.

How our Outstanding Car Finance Check Works

Car Reg Checks car history check begins with DVLA vehicle check data, you can find out more about this by visiting our Car History Check page.

Our other premium check sources include; the Motor Insurance Anti Fraud Theft Register (MIAFTR), Motor Insurance Bureau (MIB), Experian Asset Register which includes an extensive database of financial institutions, Police National Computer (PNC) and DVSA services.

To get started with an outstanding car finance check:

1. Enter registration number

Simply type a UK registered number plate into the input field above and click 'Check Now'.

Your registration number or number plate is also referred to as your VRM (Vehicle Registration Mark). It includes numbers and letters and is found on the front and rear of the vehicle.

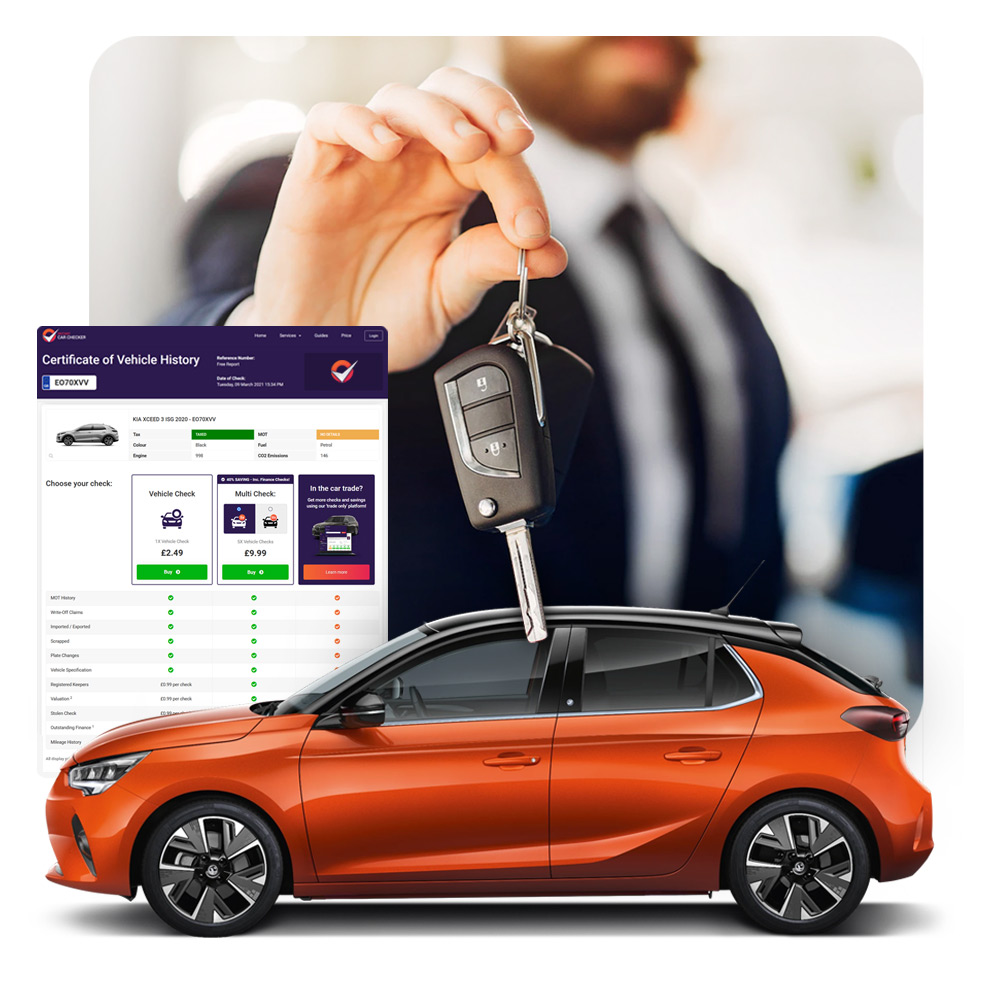

2. Choose a report type

A free yet basic DVLA vehicle check will be displayed along with our premium report options.

If you want to add more to your basic vehicle check, but don’t want a full check? No problem. Customise your car report by selecting individual check add-ons such as outstanding car finance.

3. View your car report

Enter your payment information into our secure checkout, you’ll be automatically redirected to your report.

We will also send you an order confirmation email with a unique and secure link to your car check report, so you can access it anytime and from anywhere. For enquires about your report contact us here.

Contents

Types of Car Finance Agreements

There are a range of different finance agreement types thats can be found on our vehicle provenance check reports.

It's important to note that Personal Contract Hire and Lease Purchase are two forms of financing where the borrower never actually owns the vehicle. Because of this, leased vehicles are not listed for sale.

Hire Purchase (HP)

Until the entire loan, including the final "option to purchase" charge, is repaid, the lender retains ownership of the car. If you purchase a car with an unpaid hire purchase, the lender may take it back.

Conditional Sale

In a conditional sale, the finance company retains full ownership of the car unless specific requirements are completed. These are typically the times when all bills are paid in whole and on schedule. Conditions pertaining to the vehicle's insurance and upkeep may also be included. The finance company will continue to own the vehicle if the contract is not fulfilled.

Credit Sale

In this situation, the buyer does become the owner of the vehicle, just like in other credit arrangements. If this type of finance agreement is on the car you're considering to buy, then you should ask the seller of the car for more information.

Lease, Contract Hire

The leasing/hire business is the legal owner of the car, and ownership will not transfer to you until the finance is paid in full.

Personal Contract Purchase (PCP)

The car belongs to the lender until all requirements are met, which is typically when all payments have been made. The last payment is frequently a huge "balloon"-style payment, which the lender will frequently guarantee.

Personal Loan

Despite having no rights to or interest in the car, the lender has disclosed the existence of a personal loan as part of the government's initiative to promote responsible lending. If this type of financing on the car you're considering worries you, you should ask the lender and the seller of the car for more information.

Unit Stocking

This form of financing may appear on your HPI report if you are purchasing through a dealer. Discuss it with your dealer, ascertain their responsibility, and obtain a written guarantee that they will pay off the financing on the vehicle you're purchasing. Motor dealers frequently employ unit stocking finance agreements to fund the vehicles they have on their forecourt.

Demonstration Stocking

A type of dealer financing that enables dealers to finance display cars. Discuss it with your dealer, ascertain their responsibility, and obtain a written guarantee that they will pay off the financing on the vehicle you are purchasing.

Outstanding Car Finance FAQ's

Simply enter your vehicle registration number at the top of the page and click ‘Check Now’. We will instantly check the reg against our database to see if any bank queries indicate outstanding finance.

If you want to sell a car that has outstanding finance on it, you need to arrange for the outstanding finance to be paid off before putting it on the market. While it’s not impossible to sell your car if there’s outstanding finance, you’ll need to check your lender’s terms and conditions.

Our outstanding car finance check will give you a breakdown report of the finance that is left on your vehicle. Simply enter your registration details to perform a full check. Information such as the finance agreement date and the lender’s details will be included so that you can make the necessary actions.

Our outstanding finance car check comes as part of a package of comprehensive car checks. Choose to add it onto our standard check and, as well as finding out if there’s money owing on it, it will let you know if it’s been scrapped or imported, if there’s any history of plate changes and what its MOT record is like. Upgrade to our full check and you’ll also find out if it’s been registered as stolen, receive an idea of vehicle valuation and the number of previous keepers, and get the lowdown on its mileage history.

When buying a used car, it’s important to carry out due diligence on the vehicle to make sure it can be legally sold and bought (by you). If you hand over money without checking and there’s credit owing on the vehicle, there’s no guarantee you’ll be able to keep it or get your money back.

Our stolen car check extracts data directly from a comprehensive database of financial institutions. Using data directly from this we can tell you if the car has an outstanding loan or finance agreement registered against it. It will also show the finance agreement date and the lender’s details so you follow-up if you want to. You’ll also get a range of other details, including the car’s MOT history and whether it’s ever been imported, scrapped, written-off or had its plate changed.

If you buy a vehicle that later turns out to have money owing on it, you don’t have the legal right to keep it. The car will still technically belong to the lender. You will need to let the lender know and either pay the money off, try and get your money back from the seller, or enter into a legal claim to prove its ‘good title’.

You’re entitled to expect that your seller has a 'good title' to the vehicle. This means that person selling the vehicle must own it. If you genuinely had no idea that the car had outstanding finance (and can prove this) then you might be able to keep it. This is called ‘good title’ and means you bought the car in good faith without knowing about the issue. But it won’t be easy. The lender will be looking to recoup their losses and will ask lots of questions before they agree to settle.

Car finance is easy to come by. Which explains why more than two million cars bought in the United Kingdom (UK) each year are with help from a lender. So, chances are you’re likely to stumble across at least one in your search for a used vehicle.

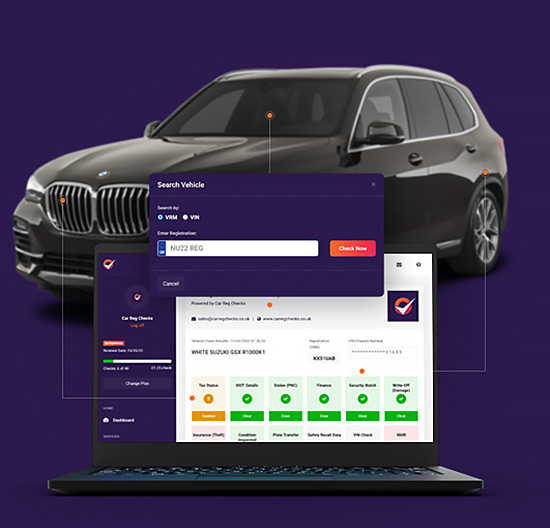

In the car trade?

Get more checks and savings using our 'trade only' platform!

Exclusively for dealers, Car Reg Checks provides vehicle validation and history data, giving you and your customers peace of mind.

- Make informed decisions, fast!

- Everything you need to know!

- Your Brand - Our Report.